how fast will a car loan raise my credit score reddit

Not necessarily since this is an installment loan as opposed to a revolving loan. Since auto loans typically last for years usually from 48 to 96 months the potential for a consistent payment history is.

What S The Minimum Credit Score For A Car Loan Credit Karma

Free Credit Monitoring and Alerts Included.

. It might not help you raise your credit. So paying it off early wouldnt save you money but youll continue to benefit. How much your credit score will increase is determined by your starting point.

But the positive effects will last for the length of. Yes a car loan does build credit but you have to keep up with all of your other billspayments. If your goal is to increase your score take out the loan make a payment of 50 of the balance on your first payment then keep the balance in a savings account and pay your loan every month.

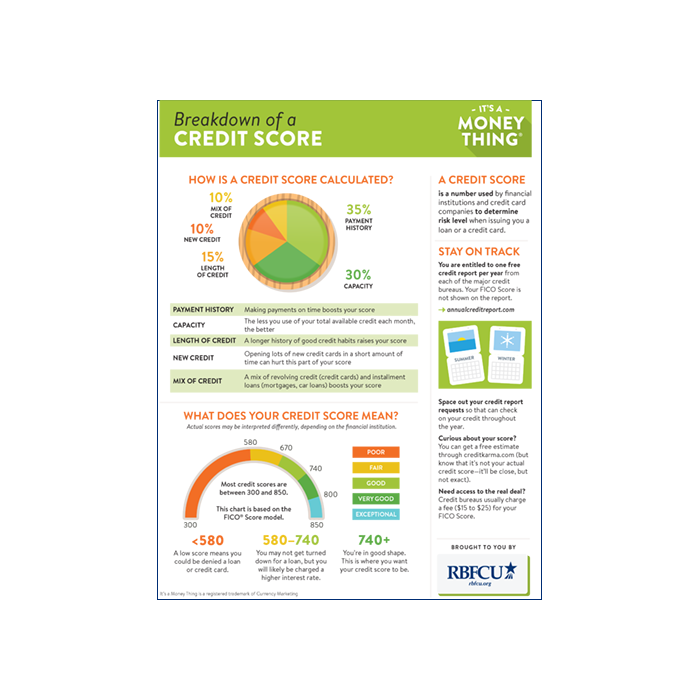

In this article Im going to explain the five factors that comprise your credit score and show. Ago edited 3 yr. A credit report is a financial statement that provides information about your credit activity along with other information like loan paying history and the status of your credit.

Basically you pay them 200 for a credit card. For instance you got a 0 financing deal. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan.

New Credit Scores Take Effect Immediately. How an auto loan can help your credit score. Ad Chase Credit Journey.

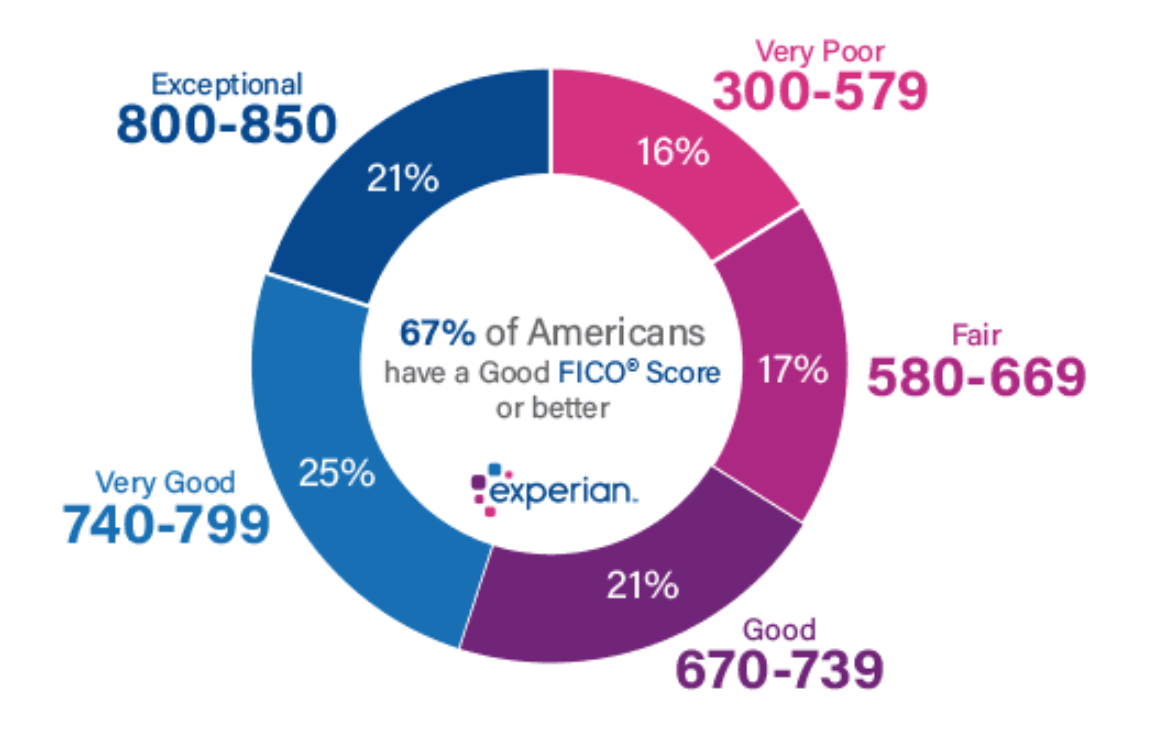

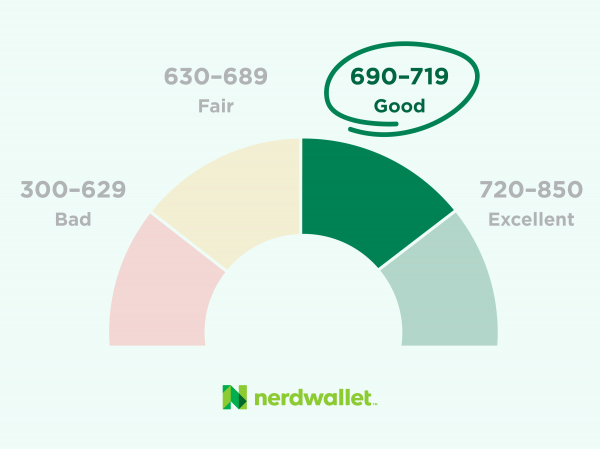

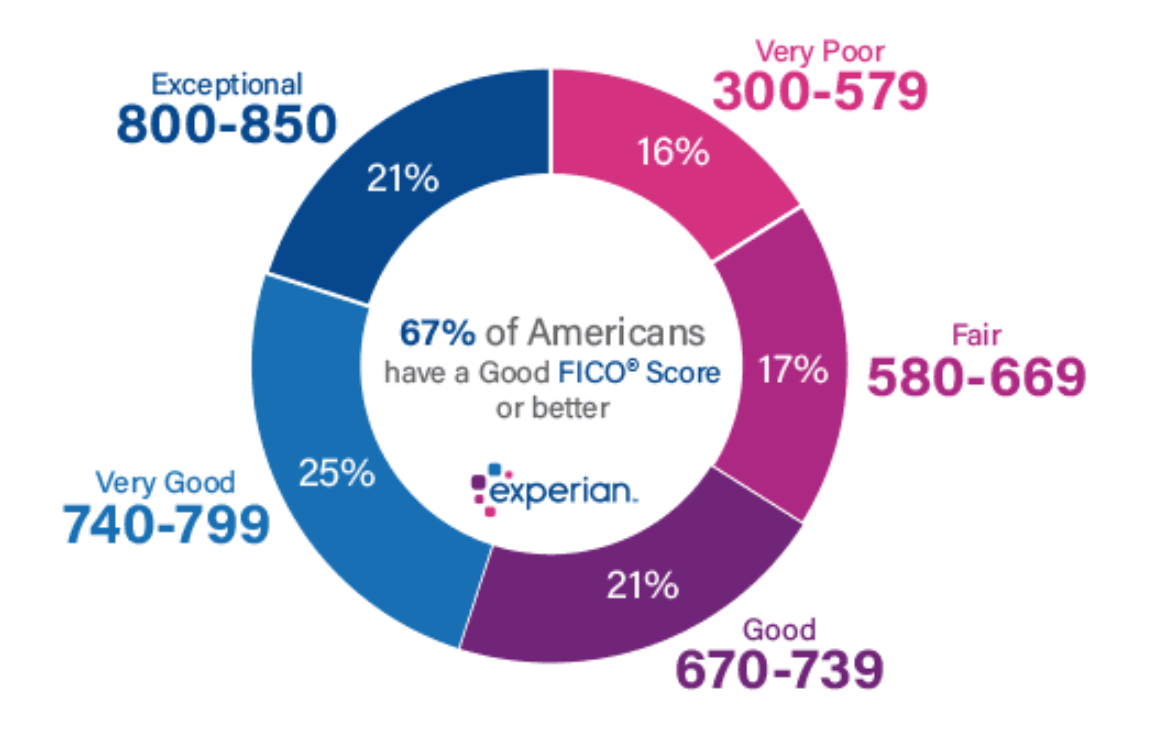

In a nutshell the FICO credit scoring formula the most commonly used scoring. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the. Fortunately any temporary hits to your credit score will vanish as time passes.

Ad You Can Increase your Credit Scores for Free only at Experian. If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest. The higher your credit scores the easier it may be to qualify for the best.

If you already have a credit score in. It works like this When your credit is so horrible that you cant get a real credit card to start boosting your credit you get a secured card. To some extent you can help raise your credit score by opening a new credit account a new credit card account a personal loan an auto.

MyAutoLoan requires applicants to have FICO credit scores of 575 or higher in order to qualify. If you have a thin credit profile then adding the car loan beef up your historyscore. Hello all my current credit score is 767 I barely opened my first credit card 7 months ago my goal is to buy a propertyhouse in the near.

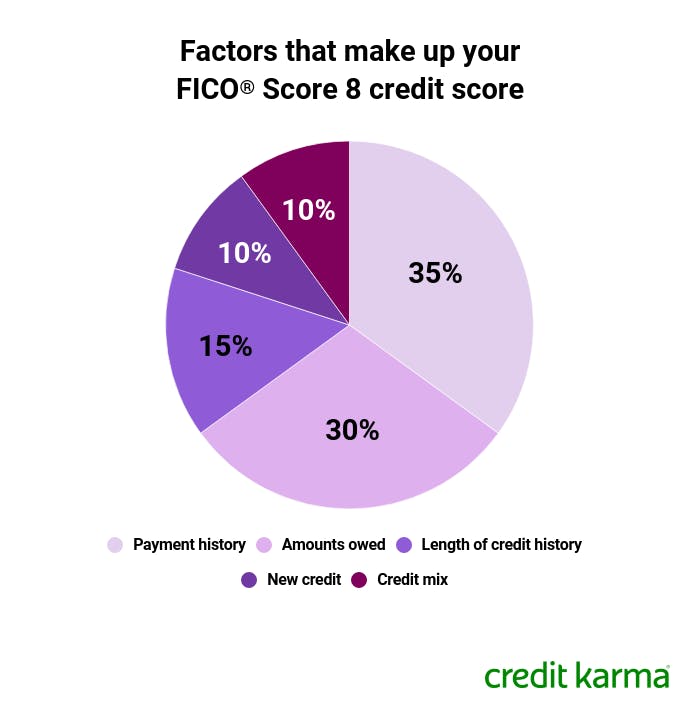

The biggest piece of the pie is payment history making up 35 percent of your credit score. How much your credit score will increase is determined by your starting point. How fast will a car loan raise my credit score reddit Thursday February 17 2022 Edit It can be possible to raise your credit score in thirty days if.

Open a New Credit Account. A car loan also helps to improve your credit mix by diversifying the types of credit you have. Having both revolving credit such as credit cards that allow you to carry a balance.

The biggest piece of the pie is payment history making up 35 percent of your credit score. No you shouldnt take on the car loan to improve your score. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit.

If you make payments on time your credit score will grow. Press J to jump to the feed. Paying off revolving debts like credit cards will.

When you take out an auto loan especially a bad credit car loan you gain the. There may be other reasons to finance the vehicle but improving your score. 35 Your history of making payments on your current and.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. This could help you develop a consistent payment history over time. Getting a car loan to improve your credit score is a waste of time and money.

There can be an upside to keeping your car loan payment. Your credit score is higher. A car loan has two common effects on credit.

It causes a hard inquiry to be added to your credit report which could temporarily lower your credit score by a few points. The length of your credit history makes up 15 of your. Since car loans can improve your credit score lets go over how your credit score is calculated.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. Set up autopay so you never forget to make a credit card payment.

Breakdown Of A Credit Score Rbfcu Credit Union

How To Get A Bad Credit Home Loan Lendingtree

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

![]()

Credit Score Report Check Loan Credit Score Apk 1 15 For Android Download Credit Score Report Check Loan Credit Score Apk Latest Version From Apkfab Com

How Much Does Self Raise Your Credit Score

What S The Minimum Credit Score For A Car Loan Credit Karma

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

How To Improve Your Credit Score Forbes Advisor

8 Best Loans Credit Cards 500 To 550 Credit Score 2022

Credit Repair Software Download Lawyer For Credit Repair Near Me Credit Repair Automation Studio Credit Repair Letters Bad Credit Repair Credit Repair

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Credit Score Needed To Buy A Car In 2021 Lexington Law

![]()

Will A Small Car Loan Improve My Credit Score R Credit

How Credit Scores Work Your Guide Student Loan Hero

Credit Scores Are Complete Fucking Bullshit I Paid My Car Off A Few Years Early And My Scores Went Down By 9 Points R Workreform